average property tax in france

As a result of simultaneous changes to the liability for social charges since 2019. This means that they are subject to a minimum tax rate.

French Tax Collectors Use A I To Spot Thousands Of Undeclared Pools The New York Times

If you need assistance with your move we have a team of France property experts that can help at every crucial stage.

. This is payable at the end of each year in December and can also be paid monthly. For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate. Tax rates range from 0 to 45.

For non-residents since 2015 the tax and Social Security payable on the. Taxe foncière property tax payable by all owners in France is deductible from the value of the relevant property. Residence Tax Taxe dhabitation.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. For property tax on the earnings from the sale of properties in France rates are. For residents of France there is currently 19 tax on the resulting gain.

Tax dHabitation iswas paid by the. 265 on profits over 38120 15 not over 38120 0 49 45 4 tax on high incomes or incomes over 500000 20 standard rate 10 restaurants transportation and. Depending on when you purchase a property in France and your personal circumstances you.

There is a 75 exemption on the value of woodland. Tax dhabitaion And Tax Foncière Tax dhabitation is being phased out and will have mostly gone by the end of 2021. The rate of stamp duty varies slightly between the departments of France and significantly depending on the age of the property.

This is not the same as property taxes. The minimum 20 tax rate or 144 for income earned in Frances overseas départements is increased to 30 or 20. Taxe foncière is a land tax and is paid by the owner of the property regardless of whether they occupy the property or whether the property is a second home or primary.

Answer 1 of 2. For properties more than 5 years old stamp. Speak to an expert.

And Social Charges which are currently 172. Rental and related investment income from France and taxable in France beyond this level is taxed at 30. For properties more than 5 years old stamp duty is.

The rate of stamp duty varies slightly between the departments of France and depending on the age of the property. Owner of a French property have to pay a tax on their property because it is capable of being lived in. This is a land tax and and is always paid by whoever owns the property on January 1st of any given.

Property owners in France have two types of annual tax to pay. Contact us on 44 020 7898.

Property Tax In The Netherlands

Property Tax Assistant Average Salary In France 2022 The Complete Guide

How Do Us Taxes Compare Internationally Tax Policy Center

Investment Analysis Of French Real Estate Market

Median Property Taxes By County Tax Foundation

Citybizlist New York Uhy Study Shows Homebuyers In The Us Have Some Of The Lowest Rates Of Property Tax In The World

French Taxes I Buy A Property In France What Taxes Should I Pay

Tax Revenue Statistics Statistics Explained

Average Price Of U S Real Estate Sold By Country International Tax Blog

Doing Business In The United States Federal Tax Issues Pwc

Taxes On Property In France French Touch Properties

France Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

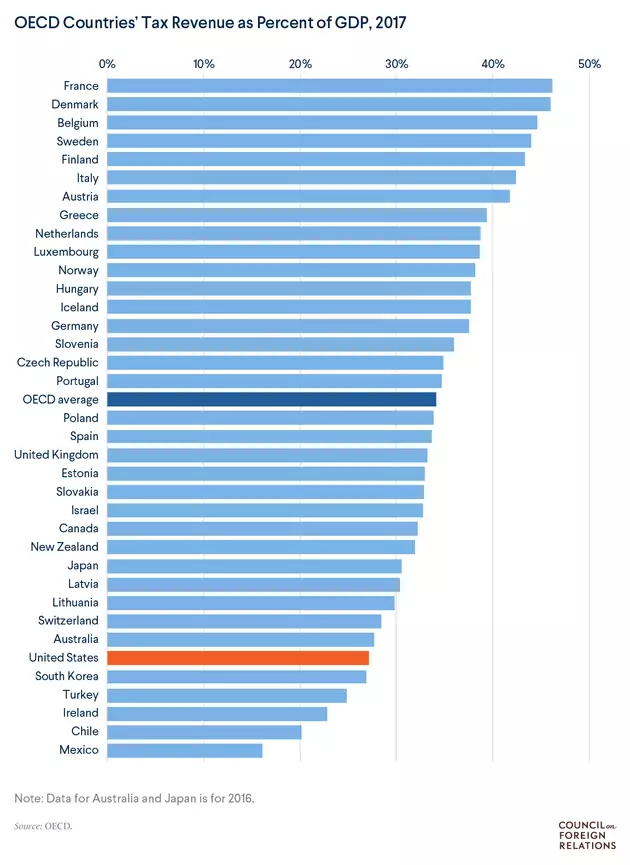

Inequality And Tax Rates A Global Comparison Council On Foreign Relations

Property Tax Assistant Average Salary In France 2022 The Complete Guide